How much do you know about getting a car on finance with low credit score?

Here at Refused Car Finance, we did a little survey to find out how much we Brits know about the impact of a credit score on your ability to obtain car finance, with some quite shocking results!

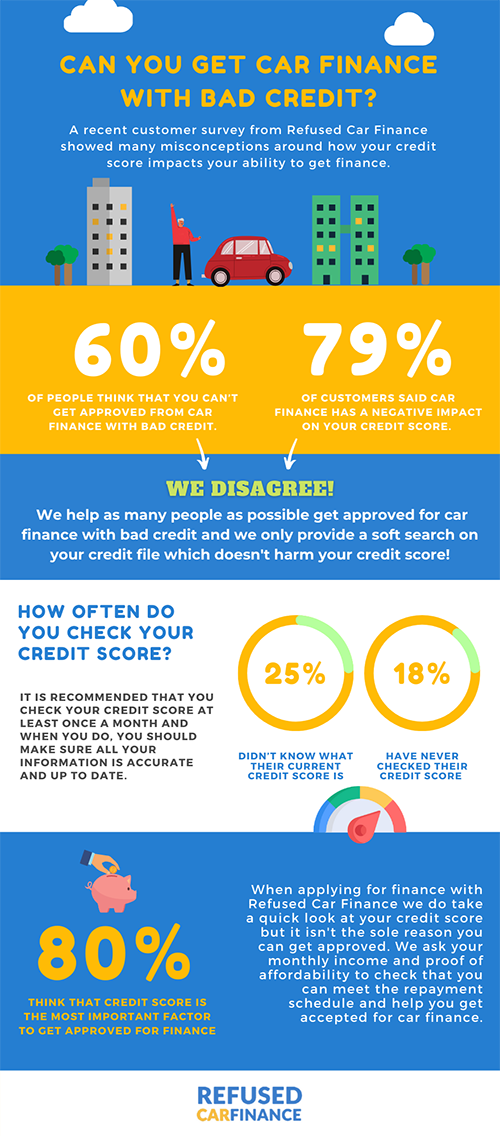

In March 2021, we conducted a customer survey that highlighted the relationship between your personal credit score and the likelihood of being accepted for car finance.

Do you know what your current credit score is?

Our survey found that nearly 80% of our customers were aware of what their current credit score is and 55% said they checked their credit score once a month, which is a great financial habit to have! Checking your credit score regularly, knowing how your credit score changes, and which factors affect your credit score can be really beneficial.

%

of customers surveyed said they checked their credit score once a month.

Does applying for car finance have a negative impact on your credit score?

%

of customers surveyed thought applying for car finance negatively affects your credit score.

We asked our customers if they thought that applying for used car finance had a negative impact on their credit score and nearly 80% of customers surveyed thought that it does negatively affect your credit score! When applying for car finance with Refused Car Finance, you shouldn’t let this misconception put you off applying for a car loan.

When you apply with us, we only provide a soft search on your credit file. A soft search doesn’t affect your credit score, and it isn’t recorded on your credit file. This type of search enables us to take a quick look at your credit file without harming your score. Find out more about hard search vs soft search credit checks.

Is your credit score the most important factor that car finance lenders use to get you approved?

When asked, over 80% of our customers said that credit score is the most important factor that car finance lenders take into account to get you approved for finance. However, we also take affordability into account to get you approved. We believe that being able to prove that you could pay back your potential car finance through affordability checks is key to getting you approved. Find out more about what does affordability mean.

Which factors affect your credit score?

We asked some of our customers which factors they think negatively affect their credit score and the results indicated that we Brits are clued-up on how your credit score can be affected, however, some results were surprising.

True

-

Making late or missing payments

Repeatedly missing payments or making late repayments can lead to defaults on your credit file and also indicates to lenders that you have poor financial responsibility, making future lenders wary of accepting you for finance. You should also avoid only paying back the minimum on your credit card each month. Any finance or loans you have should be paid back on time and in full each month.

-

Mistakes on your credit file

Mistakes on your credit file such as incorrect address or fraudulent finance applications in your name can negatively impact your credit score. You can dispute any mistakes on your credit file with your credit referencing agency that provided your credit report.

-

Having a CCJ, IVA or declaring bankruptcy

County Court Judgments, entering into an Individual Voluntary Agreement or declaring yourself bankrupt can have the biggest impact on your credit score and can remain on your credit file for up to 6 years.

-

Applying for credit often

Making multiple applications for finance using a hard search credit for car finance in a short space of time can negatively impact your credit score. Most lenders will only perform a soft search on your credit file which doesn’t leave a footprint.

-

Borrowing more than you can afford

Getting accepted for loans which you can’t pay back can result in defaults or arrears on your account. Having high levels of outstanding debt can have a negative impact on your score and also affect your chances of getting finance again in the future.

-

The number of credit accounts you have

Some potential lenders also look at the amount of credit you have available to you. Multiple credit accounts and also how much of your credit limit you use can impact your score. For example, maxing out credit cards and overdraft limits suggest to lenders that you can’t handle any more credit.

-

Being rejected for credit

Applying for finance through a hard search credit check and getting declined for finance can impact your credit score negatively. Find out more: Why have I been declined?

False

-

Your Monthly Income

When you apply with us, we will ask you to provide your income, but this factor does not affect your credit score directly. We only ask for your income to check your affordability and help get you approved.

-

Your age

How old you are doesn’t affect your credit score. You may find yourself with bad credit due to no credit history which can be related to age as many lenders or credit providers require you to be 18 years old to get finance.

-

Your employment status

You can secure finance if you are in full-time employment, self-employed, in receipt of benefits or in the armed forces! Your employment status doesn’t have an impact on your credit score though.

-

Registering to vote

Registering on the UK electoral roll can make it easier for lenders to verify that you are who you say you are and could also save you time on credit applications, but it is unclear whether registering to vote would increase your credit score.

%

of people think you can't get accepted for car finance with a low credit score

Is it possible to get a car on finance with a poor credit history?

One of the biggest surprises we found from conducting this survey is that 60% of our customers thought that you couldn’t get car finance with a poor credit score! Before they applied with Refused Car Finance, they thought that getting a car with a bad credit score was impossible. But we’re glad that we proved them wrong!

Find out more on our dedicated bad credit car finance page.